The Science Behind

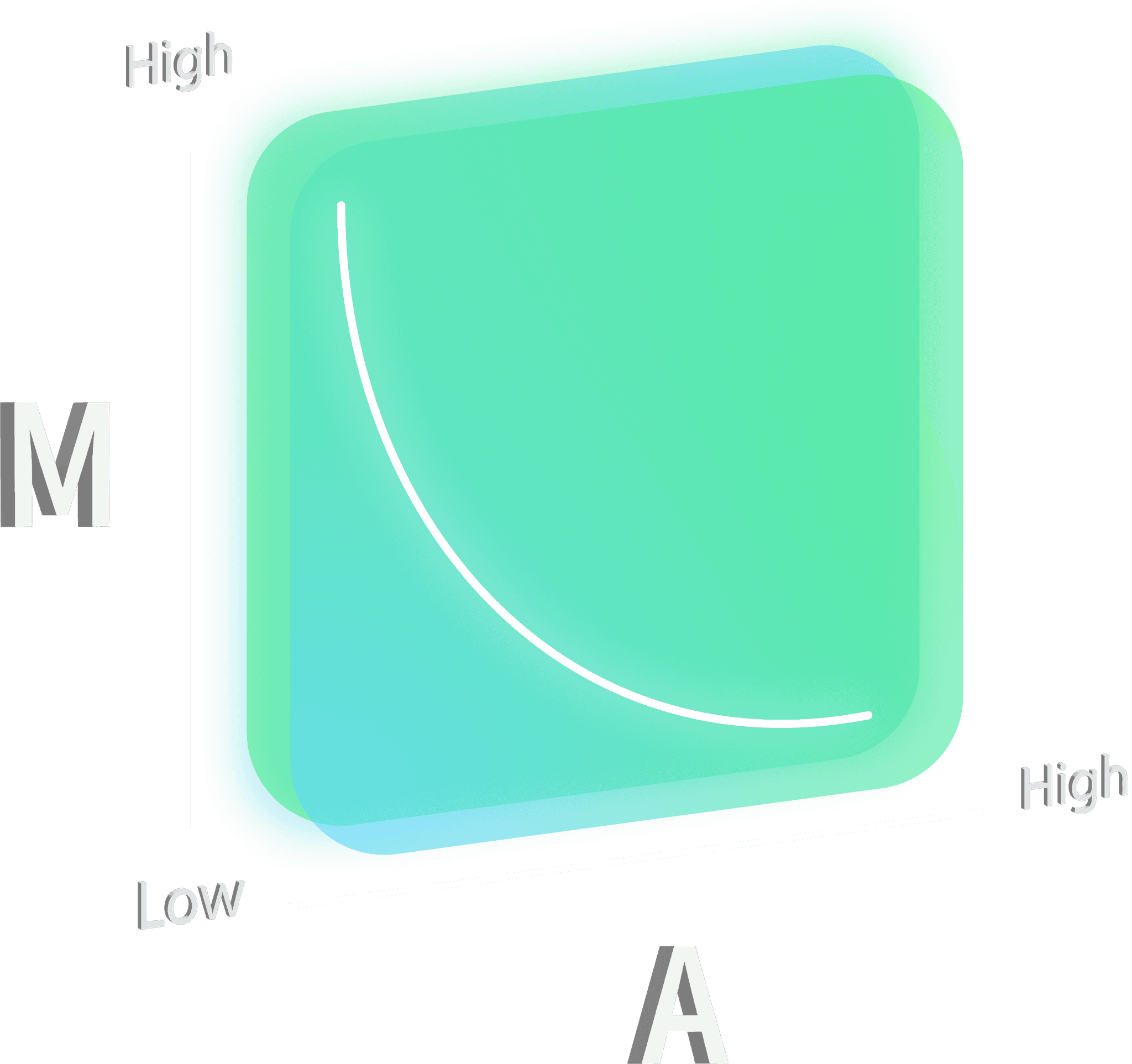

Adapting the Fogg Behavior Model into the design, "M" stands for "Motivation", and A stands for "Ability". The concept of the model in short is "Behaviors can change under influence of the combination of prompt, motivation, and ability". UX researcher can create features in products that act as prompts to encourage the changes in users' behavior

There are 3 possible behavior triggers:

• Facilitators

• Sparks

• Signals

Facilitators 📈

⬆️ M • ⬇️ A

Targeting audiences with low ability, yet they have high motivation in pursuing their goal. Facilitator triggers can be any features that is supportive and convenient for users to achieve their target, as simple as a button for easy accessibility, an analysis report, etc.

Sparks ✨

⬇️ M • ⬆️ A

Targeting audiences with high ability, yet they have low motivation in pursuing their goal. Spark triggers act as an encouragement to boost users' motivation. features can be prizes, achievement badges, or target route that users' set for themselves.

Signals 🚦

⬆️ M • ⬆️ A

Targeting audiences with high ability and high motivation in pursuing their goal. Signals are form of notification, slides button, etc.

Tools Used

The CashShield logo ingeniously combines a "$" icon within a shield, accompanied by the brand name, encapsulating the company's identity and mission succinctly. This visual fusion communicates financial protection, instilling trust in users. The strategic integration of the brand name enhances both brand awareness and identity, creating a powerful and memorable representation of CashShield's commitment to securing users' finances.

Combining the Fogg Behavior Model with a savings-focused approach involves creating a user-friendly platform with features tailored to behavior triggers.

Goal Setting acts as a Facilitator, offering a step-by-step process for users to set personalized savings goals.

Achievement serves as Sparks, incorporating a reward system and visual progress tracking to motivate users.

Reminder functions as a Signal, using timely notifications and personalized alerts to keep users engaged and informed about their savings journey.

This holistic approach aims to encourage and sustain positive money-saving behaviors.